The Ultimate Guide To Investment Advice MiFID Definition: Unlock Your Financial Potential Now!

Understanding Investment Advice MiFID Definition: A Comprehensive Guide

Investment advice plays a vital role in the financial industry, guiding individuals and businesses on their investment decisions. In the European Union, the Markets in Financial Instruments Directive (MiFID) has established a clear definition for investment advice. In this article, we will delve into the intricacies of the Investment Advice MiFID definition, exploring its what, who, when, where, why, and how.

What is Investment Advice MiFID?

Investment advice MiFID refers to the provision of personal recommendations to clients, either upon their request or on the initiative of the investment firm. These recommendations are provided with regard to transactions relating to financial instruments, such as shares, bonds, derivatives, or collective investment schemes.

3 Picture Gallery: The Ultimate Guide To Investment Advice MiFID Definition: Unlock Your Financial Potential Now!

Who Provides Investment Advice MiFID?

Investment advice MiFID is primarily offered by investment firms, authorized and regulated by the respective financial authorities in their jurisdictions. These firms employ qualified financial advisors who possess the necessary knowledge and expertise to provide investment recommendations.

When and Where is Investment Advice MiFID Provided?

Image Source: assets.ey.com

Investment advice MiFID can be provided to clients at various stages of their investment journey. It can be offered during the initial portfolio creation, periodic reviews, or when significant events impact the market. Investment advice MiFID is commonly provided through face-to-face meetings, telephone conversations, or digital platforms.

Why is Investment Advice MiFID Important?

Investment advice MiFID is crucial in ensuring that clients receive personalized recommendations tailored to their financial goals, risk appetite, and investment horizon. It helps individuals and businesses make informed investment decisions, aligning their portfolios with their desired investment outcomes.

How Does Investment Advice MiFID Work?

Image Source: squarespace-cdn.com

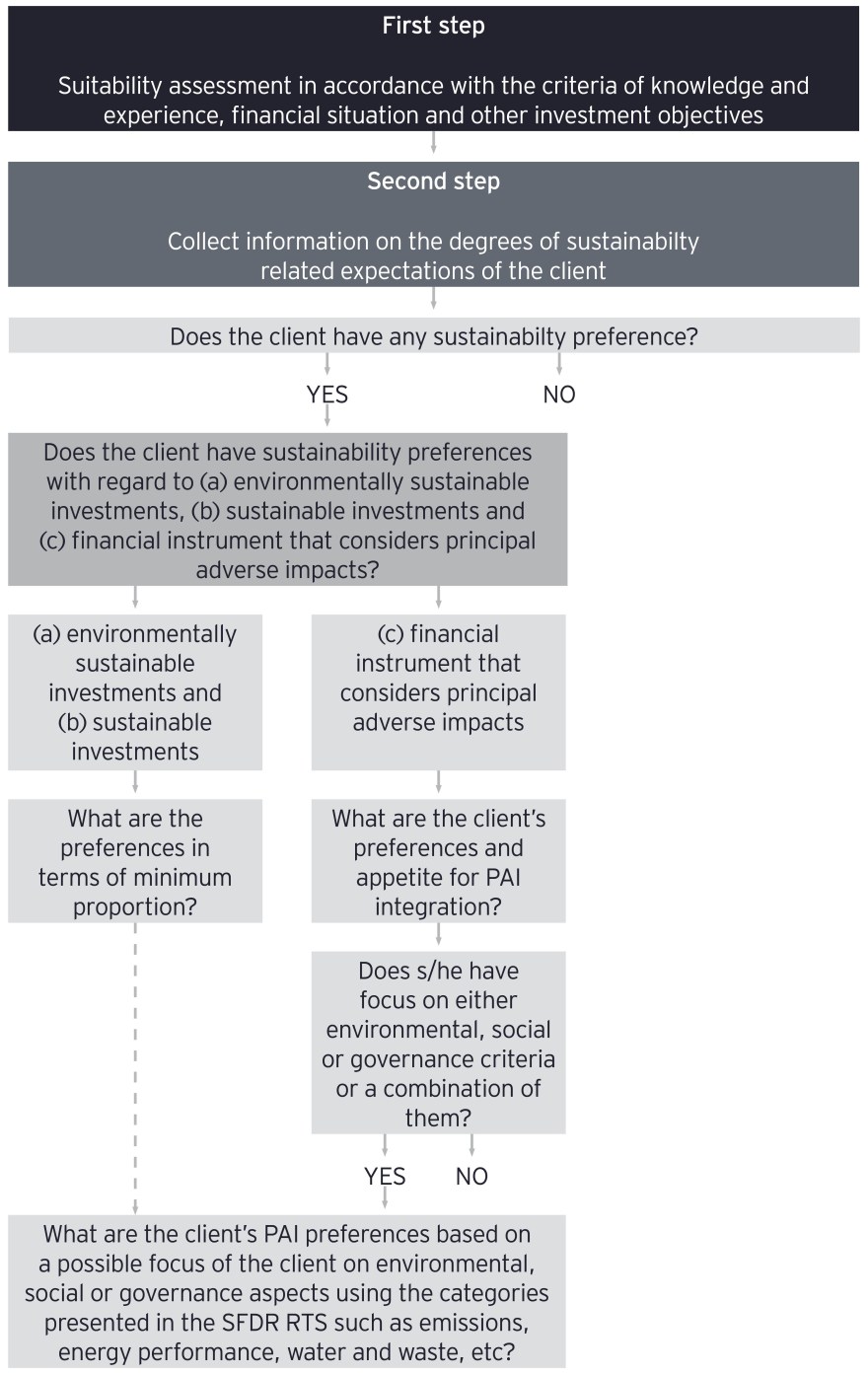

Investment advice MiFID follows a structured process to ensure the suitability and appropriateness of the recommendations provided. Financial advisors gather information about the client’s financial situation, investment objectives, and risk tolerance. Based on this information, they analyze the client’s needs and preferences and propose suitable investment options.

FAQs about Investment Advice MiFID Definition

Q: Is investment advice MiFID mandatory?

A: Investment advice MiFID is not mandatory for clients. Clients have the choice to seek or decline investment advice from authorized investment firms.

Q: Are there any fees associated with investment advice MiFID?

Image Source: bankinghub.eu

A: Yes, investment firms typically charge fees for providing investment advice MiFID. These fees can be charged as a percentage of the assets under management or as a flat fee.

Q: What are the potential benefits of investment advice MiFID?

A: Investment advice MiFID offers several benefits, including professional guidance, personalized recommendations, risk management, and access to a wide range of investment opportunities.

Q: Are there any disadvantages of investment advice MiFID?

A: One potential disadvantage of investment advice MiFID is the cost associated with professional services. Additionally, clients may have limited control over the investment decisions made on their behalf.

Conclusion

Investment advice MiFID plays a crucial role in guiding individuals and businesses on their investment decisions. With a clear definition and regulatory framework, clients can trust that investment advice provided by authorized firms adheres to industry standards. When seeking investment advice, it is important to consider one’s financial goals, risk tolerance, and the associated costs. By making informed decisions, clients can make the most of their investment journey and work towards achieving their financial objectives.

This post topic: Investment Tips